The Greatest Guide To How is the COVID-19 Economic Injury Disaster Loan program

BEST DAY EVERRRRR - Will put timeline in comments after I'm done crying! Also, was in prior recon: EIDL

Getting My SBA to Increase EIDL Loan Amounts to $2 Million After Labor To Work

Nevertheless, the number of employees is higher for businesses in some industries. The SBA Table of Small Company Size Standards shows whether your market enables more employees. Recommendations to alternate use of receipts (income) instead of number of employees do not obtain the COVID-19 EIDL. Location and business type basic Since the coronavirus (COVID-19) pandemic uses to all 50 U.S.

EIDL 2.0 News 2021 - Major Changes On How to Use SBA EIDL Loan Funds - FreedomTax Accounting, Payroll & Tax Services

territories, virtually any small organization in the United States and its territories certifies by location. In addition to what the majority of people would consider a company, these standards and loan accessibility choices also use to sole proprietorships, independent contractors, and self-employed persons. Loan Approval Conditions The following loan approval conditions reflect some relaxing of standard EIDL stipulations: You can obtain approximately $200,000 without an individual guarantee.

You do not need to prove you could not get credit somewhere else. Loans of $25,000 or less require no collateral. For Answers Shown Here above $25,000, a general security interest in service assets can be used. You should enable the SBA to evaluate your company tax records. April 6, 2021 Since this date, EIDL loans up to $500,000 covering two years of economic hardship are readily available.

SBA to Increase Lending Limit for COVID-19 Economic Injury Disaster Loans - New Jersey Business Magazine

Since April 6, 2021, you can request an EIDL of as much as $500,000 covering 24 months of economic injury to pay expenditures such as set debt and payroll expenses. Some loans processed prior to that date may be eligible for a boost, and the SBA will notify those borrowers.

Top Guidelines Of Login - SBA Economic Injury Disaster Loan Portal Application

75% (2. 75% for nonprofits) and the loan term can be for as long as 30 years. The COVID-19 EIDL includes an automatic one-year deferral on repayment, though interest starts to accumulate when the loan is paid out. If you receive and receive a Targeted EIDL Advance, the funds you get are fully forgivable.

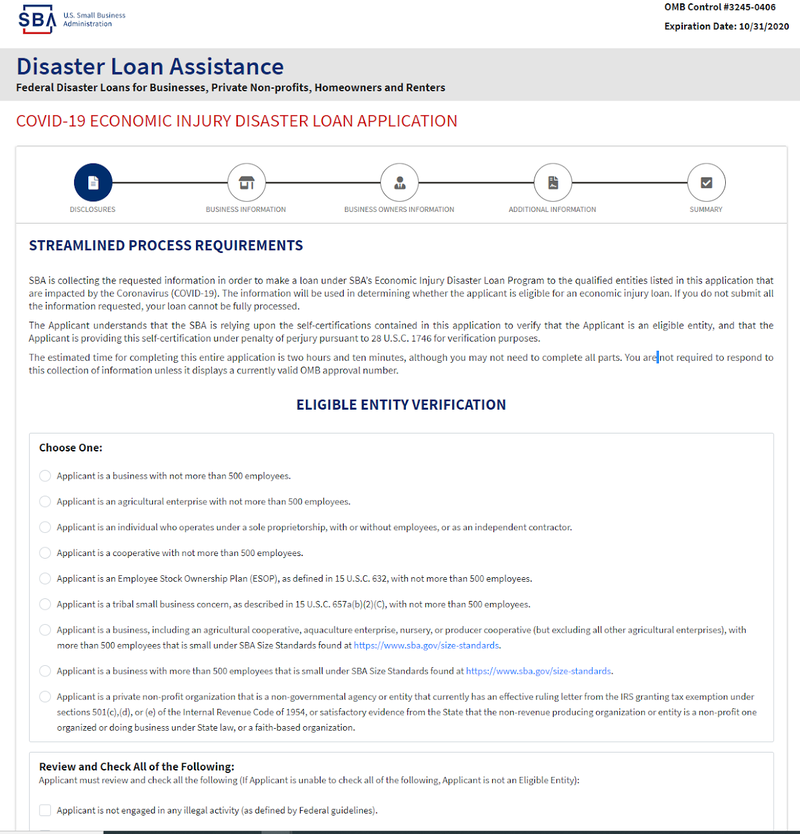

The section below titled New Targeted EIDL Advance provides extra details on the new advance program including conditions under which you may qualify. Structured Application EIDLs are moneyed by the SBA, so you make your application with the SBA. For the COVID-19 variation of the EIDL, the application procedure has actually been streamlined; the SBA states it should take you two hours and 10 minutes or less to finish the application.